The Israeli Rental Market 2026

Introduction: A Market in Tension

Something unusual is happening in the Israeli housing market. For the first time in years, rental prices and home sale prices are moving in opposite directions. While the average price of a home for sale in Israel fell by 2.5 percent year-over-year in the third quarter of 2025, rents rose by 4.4 percent over the same period, reaching a national average of 4,952 shekels per month. This divergence has created a rental market that is tighter, more expensive, and more consequential than ever for the millions of Israelis who do not own their homes.

This analysis draws on two primary data sources. The first is the Israel Central Bureau of Statistics, which publishes quarterly rent data based on actual lease contracts across the country. The second is Yad2.co.il, Israel’s largest real estate listing platform, which as of February 2026 hosts nearly 30,000 active rental listings. Together, these sources provide both the statistical backbone and the real-world texture needed to understand how rental prices vary by apartment size, city, and region.

In Israel, apartment sizes are measured by “rooms” in a way that differs from international convention. The living room is counted as a room, so a “3-room apartment” typically means two bedrooms plus a living room, equivalent to what most Westerners would call a two-bedroom apartment. A “2-room” apartment is effectively a one-bedroom, and a “5-room” apartment offers four bedrooms. This report examines all four categories, from the compact two-room units favoured by students and young professionals to the spacious five-room family homes that represent the upper end of the rental market.

National Overview: What Israelis Pay Today

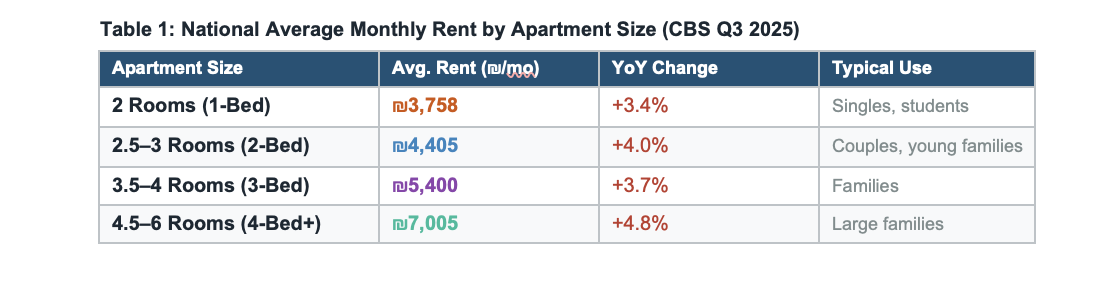

The Central Bureau of Statistics published its most recent rental data for the third quarter of 2025, and the numbers tell a story of steady, persistent inflation across every apartment size category. The national average rent for all apartment types combined reached 4,952 shekels per month, marking a 1.5 percent increase from the previous quarter and a 4.4 percent rise compared to the same period a year earlier.

Breaking this down by apartment size reveals a clear pattern: larger apartments are not only more expensive in absolute terms but are also experiencing faster rent growth, driven by high demand from families who have been priced out of the purchase market and remain renters for longer periods.

The most striking figure in this table is the 4.8 percent annual increase for the largest apartments. At an average of 7,005 shekels per month, a five-room rental now costs nearly twice what a two-room apartment does. The premium for space has widened considerably over the past several years, reflecting a structural shortage of large apartments in desirable areas and the growing number of families who cannot afford to purchase homes at current market prices.

To put these numbers in context, the national average rent of 4,952 shekels represents roughly 25 percent of the average Israeli household’s monthly expenditure of approximately 19,873 shekels, according to CBS data. For households renting in Tel Aviv, the rent burden is significantly higher, often consuming 35 to 40 percent of income.

City-by-City Analysis: Where the Money Goes

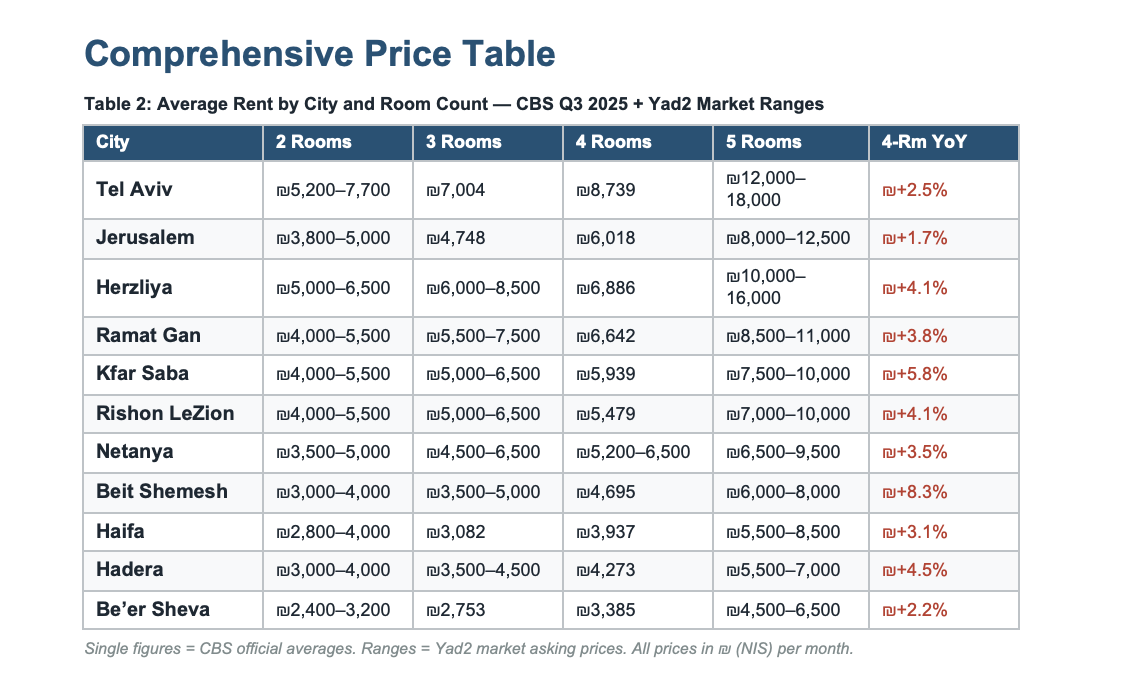

Israel’s rental market is defined by geography. The gap between the most expensive and most affordable cities is enormous — a three-room apartment in Tel Aviv costs more than double what the same apartment costs in Be’er Sheva. Understanding these differences is essential for anyone looking to rent, invest, or simply understand the Israeli economy.

Tel Aviv: The Pinnacle of Israeli Rents

Tel Aviv remains, by a considerable margin, the most expensive rental market in Israel. The CBS reports that the average rent for a three-room apartment in Tel Aviv reached 7,004 shekels in the third quarter of 2025, rising a relatively modest 1.5 percent year-over-year. For four-room apartments, the average hit 8,739 shekels, a 2.5 percent annual increase.

What is notable about Tel Aviv is that the rate of increase has actually moderated compared to other cities. This likely reflects the fact that Tel Aviv rents have already reached levels that strain the budgets of most tenants. The market is approaching a ceiling, though limited supply and a vacancy rate of approximately 2.5 percent keep prices elevated. On Yad2 today, two-room apartments in Tel Aviv range from approximately 5,200 to 7,700 shekels depending on neighbourhood and condition. A four-room apartment in a desirable area like Hadar Yosef is listed at 12,500 shekels, while premium five-room apartments in North Tel Aviv can reach 25,000 shekels or more.

Jerusalem: Steady and Strong

Jerusalem is Israel’s second most expensive rental market. A three-room apartment averages 4,748 shekels per month, with a notable 3.9 percent annual increase. Four-room apartments average 6,018 shekels, up 1.7 percent. The capital’s rental market is driven by diverse demand — a mix of local families, students at Hebrew University, government workers, and a significant international population. Prices are roughly 30 to 35 percent lower than Tel Aviv but rising steadily.

The Gush Dan Satellites: Ramat Gan, Herzliya, and Rishon LeZion

The cities surrounding Tel Aviv form the heart of Israel’s central rental market. Ramat Gan’s four-room apartments average 6,642 shekels, while Herzliya commands 6,886 shekels for the same category. Both cities have benefited from overflow demand as renters are priced out of Tel Aviv proper. On Yad2, a new three-room apartment in Ramat Gan’s Aliyot neighbourhood lists at 7,500 shekels, while a penthouse five-room apartment in the Ben Gurion area asks 9,000 shekels. Kfar Saba, further from the core, has seen one of the sharpest increases at 5.8 percent for four-room apartments, reaching 5,939 shekels — evidence that demand is rippling outward.

Haifa: Affordability with a View

Haifa offers a dramatically different proposition. The average three-room apartment rents for just 3,082 shekels, less than half the Tel Aviv equivalent. Four-room apartments average 3,937 shekels. Year-over-year increases of 3.1 to 4.3 percent indicate growing demand, yet prices remain affordable by Israeli standards. On Yad2, a four-room garden apartment in the Carmel Ma’aravi neighbourhood lists at 5,500 shekels for 155 square metres — a space that would command three times the price in central Tel Aviv. A two-room apartment in Savionei HaCarmel lists at just 3,000 shekels with a sea view.

Be’er Sheva and the South: Budget-Friendly Living

Be’er Sheva remains the most affordable major city. A three-room apartment averages 2,753 shekels, and a four-room apartment 3,385 shekels. Annual increases are the most modest among major cities at 2.2 percent for four-room units. The Southern District as a whole averages 3,928 shekels for a four-room apartment, while the Northern District is even lower at 3,432 shekels. For investors, these areas offer the highest rental yields in the country, ranging from 4 to 5 percent gross.

The Surprise: Beit Shemesh

The most dramatic story in the Q3 2025 data belongs to Beit Shemesh, where four-room apartment rents surged by 8.3 percent year-over-year to reach 4,695 shekels. This is by far the sharpest increase among all surveyed cities. Beit Shemesh’s rapid population growth, driven largely by its religious community, has outpaced new housing construction, creating intense pressure on the rental market. Hadera, at 4.5 percent growth, and Kfar Saba, at 5.8 percent, also show that the fastest rental inflation is occurring not in the traditional expensive centres but in mid-tier cities absorbing demand spillover.

Comprehensive Price Table

Regional Disparities: A Tale of Two Countries

The regional breakdown of four-room apartment rents reveals what many Israelis already feel intuitively: there are effectively two housing markets in the country. The Tel Aviv District, where the average four-room apartment costs 7,096 shekels, is more than double the Northern District, where the same apartment averages 3,432 shekels. The Central District sits at 5,479 shekels, the Jerusalem District at 5,860 shekels, the Haifa District at 3,981 shekels, and the Southern District at 3,928 shekels.

These disparities are not merely about geography; they reflect deep structural differences in the labour market, infrastructure, and urban development. Tel Aviv’s concentration of technology companies, financial institutions, and cultural amenities creates a gravitational pull that sustains premium pricing despite periodic economic uncertainty. The northern and southern periphery, by contrast, offers affordable housing but fewer high-paying employment opportunities, a trade-off that has defined Israeli domestic migration patterns for decades.

Snapshots from Yad2: Real Listings, Real Prices

Statistics tell part of the story, but the listings themselves reveal the texture of the market — what your money actually buys in different parts of Israel. The following is a selection of active listings from Yad2.co.il as of February 6, 2026, chosen to illustrate the range of prices and conditions across apartment sizes.

Two-Room Apartments

In Haifa’s Savionei HaCarmel neighbourhood, a 50-square-metre two-room apartment with a sea view and proximity to a park lists at just 3,000 shekels — one of the most affordable urban rentals in the country. In Netanya, a two-room apartment on HaKabala Street near the sea with a protected safe room lists at 4,100 shekels, recently reduced by 150 shekels. At the other end of the spectrum, Yad2 data and market analyses place two-room apartments in central Tel Aviv at 5,200 to 7,700 shekels, with the average around 5,200 shekels even for modest units without elevators.

Three-Room Apartments

The three-room category is the workhorse of the Israeli rental market, serving couples and small families. In the northern city formerly known as Nazareth Illit, Yad2 shows a three-room apartment at 3,300 shekels in the Ramot Remez area. Moving to the centre, a three-room unit on HaTzvi Street in Tel Aviv’s Ramat HaTayasim lists at 5,500 shekels for 65 square metres. In Ramat Gan’s Aliyot neighbourhood, a newer three-room apartment with a safe room and parking commands 7,500 shekels — a 36 percent premium over the older Tel Aviv listing despite offering more space and better amenities. A Blueground-managed three-room apartment on Malchei Street in central Tel Aviv lists at 14,800 shekels, illustrating the premium that furnished, professionally managed units command.

Four-Room Apartments

Four-room apartments are the family standard. In Kiryat Ono, a four-room unit on Derech Levi Eshkol with a park view lists at 5,800 shekels for 84 square metres. In Haifa, a generous 155-square-metre garden apartment in Carmel Ma’aravi is available for 5,500 shekels with parking. Givatayim’s HaLe’ah neighbourhood offers a renovated four-room apartment at 8,500 shekels. In Tel Aviv’s Hadar Yosef, a four-room apartment with safe room and parking lists at 12,500 shekels for 108 square metres. And in the luxury segment, a four-room apartment on Isaac Stern Street in south Tel Aviv commands 17,000 shekels for 155 square metres in a new building.

Five-Room Apartments

The five-room segment displays the widest price range. In Netanya, two very different listings illustrate this: a 158-square-metre five-room apartment in a new building with safe room and parking lists at 7,500 shekels, while another five-room unit on David HaMelech Street near the sea asks 7,600 shekels for 146 square metres. In Ramat Gan, a penthouse five-room apartment of 200 square metres in the Ben Gurion neighbourhood lists at 9,000 shekels. At the top of the market, a five-room apartment on Ramat Aviv Gimel’s Recanati Street lists at 15,500 shekels, while a renovated five-room unit on Dubnov in North Tel Aviv reaches 25,000 shekels for 170 square metres. The most extreme listing found was a 42nd-floor five-room apartment in Gani Sharona near the Kirya at 33,000 shekels for 215 square metres.

Key Findings and Market Dynamics

The Rent-Sale Price Divergence

The most significant structural story in the Israeli housing market right now is the divergence between rents and sale prices. Home sale prices fell 2.5 percent year-over-year in Q3 2025, marking the seventh consecutive monthly decline. Meanwhile, rents rose 4.4 percent. This unusual dynamic is being driven by potential buyers staying in the rental market longer as they wait for further price declines, effectively increasing rental demand while reducing purchase demand. National gross rental yields have improved to approximately 3.1 percent as a result, up from 2.76 percent a year earlier.

The Affordability Migration

The fastest rent increases are no longer in Tel Aviv, where growth has moderated to the low single digits. Instead, the most intense pressure is in mid-tier cities like Beit Shemesh, Kfar Saba, and Hadera. This pattern suggests an affordability-driven migration: families and individuals who can no longer afford central locations are moving outward, and their arrival in secondary cities is driving up rents in those markets. This ripple effect means that the benefits of living in a cheaper city are gradually diminishing as demand follows the population outward.

The Family Squeeze

Large apartments are experiencing the fastest rent growth. The 4.8 percent annual increase for 4.5-to-6-room apartments significantly outpaces the 3.4 percent increase for 1-to-2-room units. Families need space, and in a market where purchasing a family-sized apartment in the centre costs upwards of five million shekels, many are choosing to rent indefinitely. This is creating sustained upward pressure on rents for larger apartments, particularly in the central and Jerusalem districts.

The North-South Opportunity

For both renters seeking affordability and investors seeking yields, the northern and southern periphery remains the most attractive option. A four-room apartment in the Northern District averages 3,432 shekels — less than half of Tel Aviv’s 7,096 shekels. Gross rental yields in Be’er Sheva reach 4 to 5 percent, compared to just 2.5 to 3 percent in Tel Aviv. The trade-off, of course, is access to employment, cultural amenities, and the social networks concentrated in the centre. But with remote work becoming more common and government incentives for peripheral development, this calculus is slowly shifting.

Conclusion

The Israeli rental market in early 2026 is a paradox: home sale prices are falling, yet rents continue to climb. For the approximately 32 percent of Israeli households that rent rather than own, this means continued financial pressure, particularly in the centre of the country. The data from both the CBS and Yad2 paint a consistent picture of a market where demand outstrips supply, where families are being pushed to the periphery, and where the gap between the most and least expensive areas continues to widen.

For prospective tenants, the practical implications are clear: the further from Tel Aviv you are willing to live, the more apartment you can afford, but even mid-tier cities are no longer the bargains they once were. For investors, improving rental yields offer modest opportunity, particularly in the south and north. And for policymakers, the data underscores the urgency of addressing the structural housing shortage that underpins this relentless upward pressure on rents.

The numbers in this report will change. The dynamics driving them will not — at least not quickly. Israel’s rental market is a reflection of its geography, its demographics, and its economy, and understanding it requires the kind of granular, data-driven analysis that sources like Yad2 and the CBS make possible.

Methodology and Sources

This analysis is based on two primary data sources:

• Israel Central Bureau of Statistics (CBS) Q3 2025 rental data, published alongside the Consumer Price Index and Housing Price Index in November 2025. CBS data reflects actual lease contract prices across Israel, broken down by apartment size, city, and district.

• Yad2.co.il live rental listings, accessed on February 6, 2026. Yad2 is Israel’s largest classified listings platform, hosting approximately 29,951 active rental listings at the time of access. Sample listings were selected to represent the price range across different apartment sizes and cities.

Where CBS provides a single average figure, it is reported as such. Where Yad2 provides a range of asking prices, both endpoints of that range are given. All prices are denominated in Israeli new shekels (₪ / NIS) per month. Room counts follow the Israeli convention where the living room is counted as a room.